Ranking

General trend and Group ranking

The reputation of Italian companies

Reputational drivers relevance in the insurance sector

The factors that most influence reputation in the public opinion are different according to the business sector.

In the survey RepTrak®, the insurance sector the most important reputational factors are (1) Product & Services, (2) Performance and (3) Conduct.

Reputational drivers performance in the insurance sector

69.7 is the average score of the companies, recorded in Italy, belonging to the segment ‘Insurance’, according to the ranking RepTrak®.

Reputation of the Unipol Group

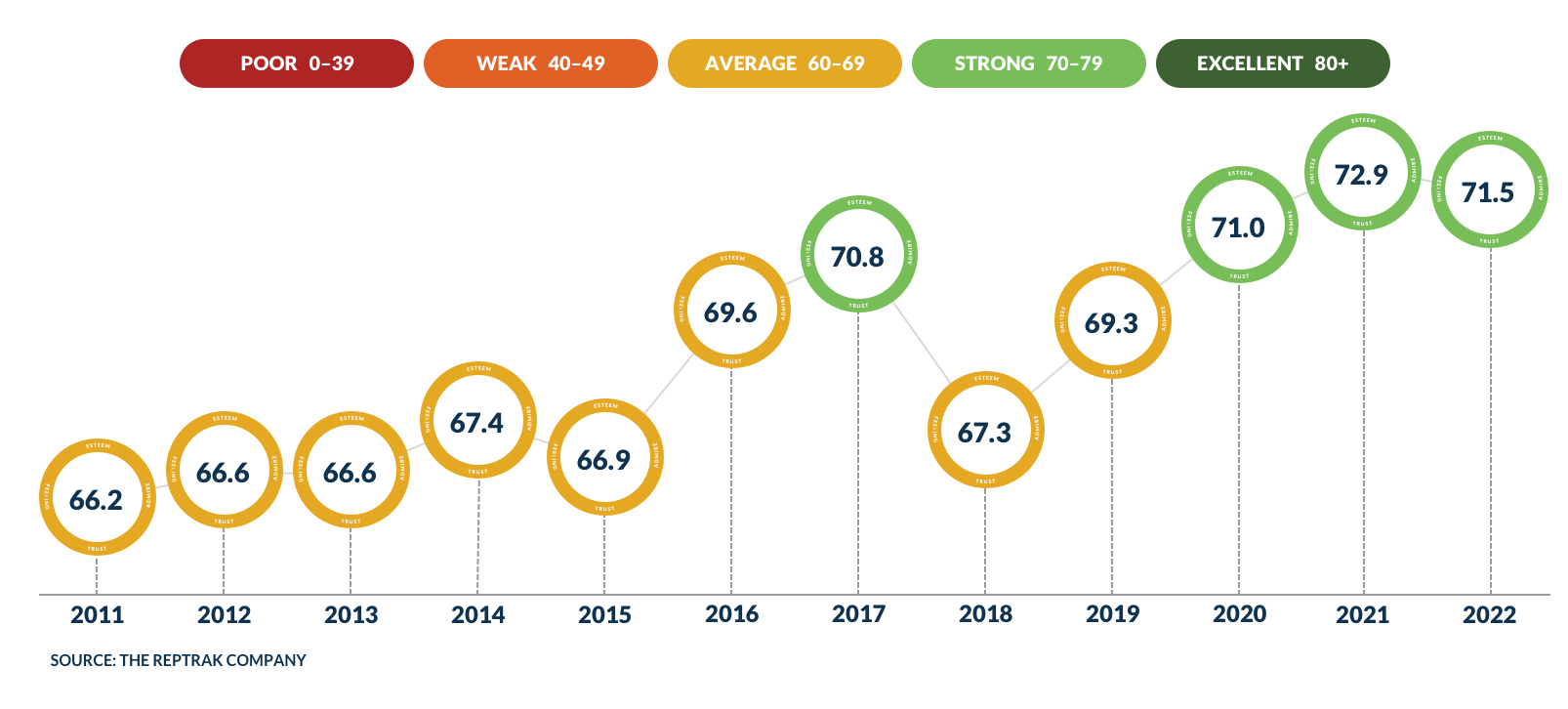

The 2022-2024 Strategic Plan sets the objective of maintaining Unipol's reputation above the sector average, confirmed in 2022.

However, the commitment on which the Group measures itself is more challenging: to remain permanently in the strong reputational range (score > 70 pt) and to guarantee a stable growth trend for the index».

The Group confirms as the level of Risk Appetite the maintenance of the RepTrak® Pulse Score index among the "Public Opinion" stakeholder above the threshold of 60, the lower limit of the "Average/Moderate" band.